No Country for Thin Margins: Amazon Squeezes Sellers with Low Inventory Level Fees

Amazon recently announced yet another fee increase, this time targeting sellers with low inventory levels. The new fees, taking effect April 2024, will charge sellers maintaining less than a 28-day supply of inventory. According to Amazon, low seller inventories “inhibit our ability to distribute products across our network, degrading delivery speed and increasing our shipping costs.” But that explanation fails to convince many resellers already feeling burdened by mounting financial pressures. This comes as Amazon faces growing antitrust probes over alleged anti-competitive actions. Critics argue Amazon abuses its marketplace gatekeeper power to undermine fair competition and impose restrictive policies that disproportionately hurt sellers and consumers. Despite lawsuits and backlash, Amazon shows no signs of backing off its measures to extract always more revenue from resellers already feeling the platform stacks the deck against them in favor of Amazon’s interests.

What Exactly is the Low Inventory Fee?

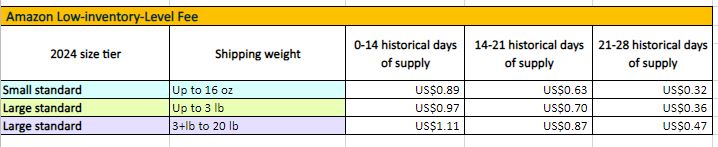

According to Amazon:

“Effective April 1, 2024, a low-inventory-level fee will apply to standard-sized products with consistently low inventory relative to customer demand. When sellers carry low inventory relative to unit sales, it inhibits our ability to distribute products across our network, degrading delivery speed and increasing our shipping costs. The low-inventory-level fee will only apply if a product’s inventory levels relative to historical demand (known as historical days of supply) are below 28 days (about 4 weeks).

We will only charge the low-inventory-level fee when both the long-term historical days of supply (last 90 days) and short-term historical days of supply (last 30 days) are below 28 days (4 weeks). For example, if a product’s short-term historical days of supply is above 28 days (about 4 weeks) but long-term historical days of supply is below 28 days (about 4 weeks), the low-inventory-level fee won’t apply.”

If you want to check if the Low Inventory Fee is really going to take effect on April Fools’ Day, you can visit Low-inventory-level fee page for more details.

How to Calculate the New Low Inventory Fee?

Basically, the fee targets the sellers who have inventory with less than 28 days of supply. Amazon sellers must maintain an inventory with days of supply superior to 28 days or they will pay a fee. The shorter the days of supply are, the higher the fees would be. Here are the metrics you need to look at for calculating the low inventory fees.

- The Size of the item

- The Weight of the item

- The Historical Days of Supply (Days of supply corresponds to the average number of days that your inventory levels can sustain customer demand by considering past sales data)

- Parent ASIN Metric (Products that shares the same variables such apparel with the different size and colors)

*Data from Amazon Seller Central

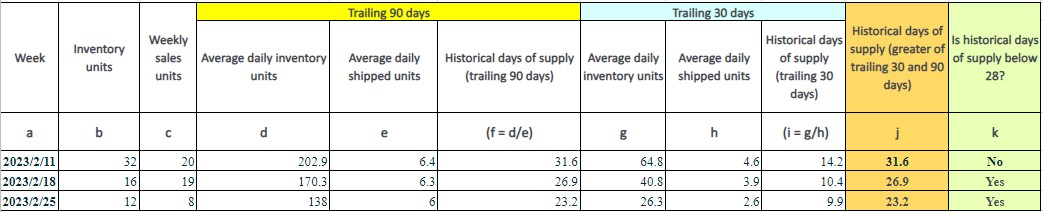

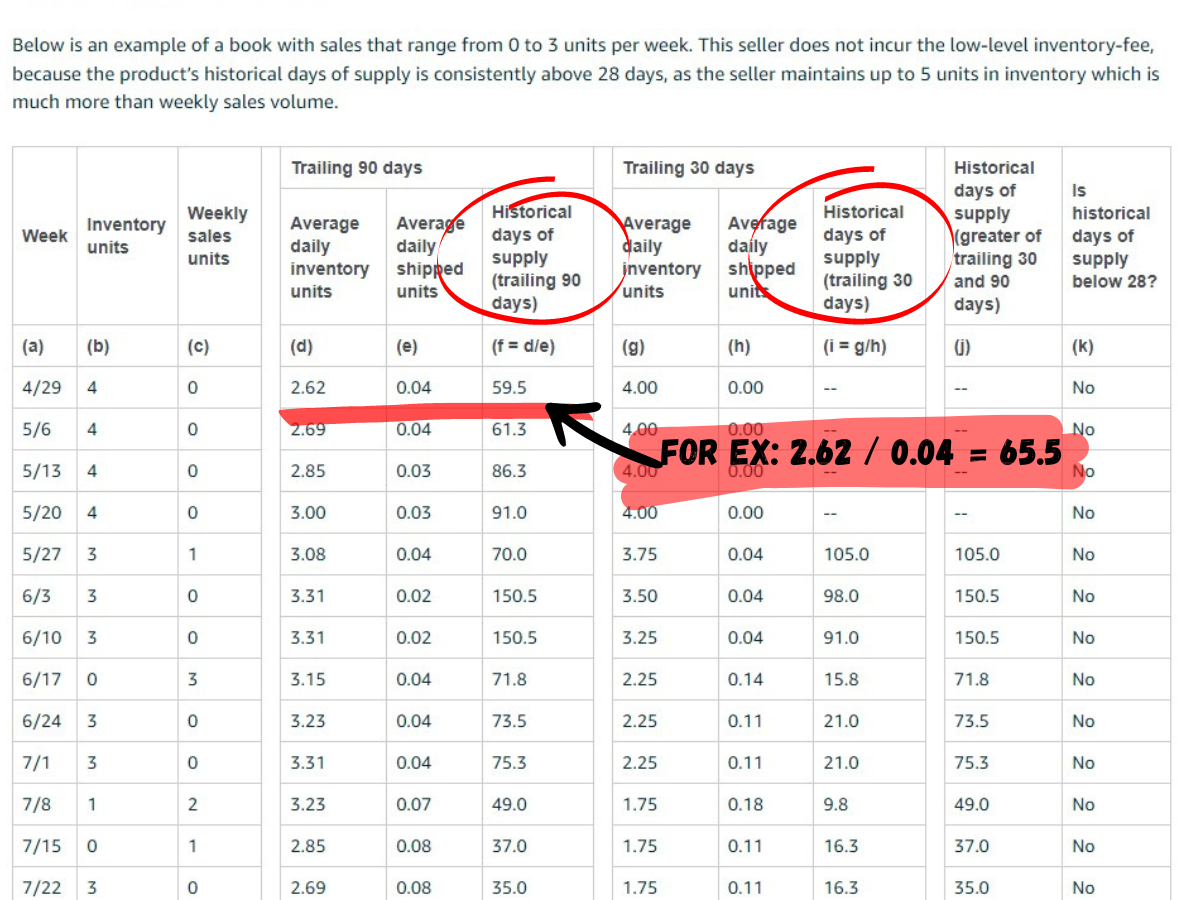

Historical days of supply calculation: Average daily inventory units / Average daily shipped units.

*Data from Amazon Seller Central

Amazon and its Great Sense of Detail (/sarcasm)

After a closer examination of Amazon Seller Central and the different examples, it appears the provided fee calculations actually contain errors. We double checked the figures presented in Amazon’s low inventory fee breakdown table but found inconsistencies with the historical days of supply (trailing 90 days). The calculation explained by Amazon (f= d/e) and (I= g/h) columns displayed different numbers that do not match the numbers they used for the calculation.

We suggest sellers verify the precise low inventory fee due for their specific items by contacting Amazon customer support. Do not rely solely on Amazon’s fee documentation and examples.

Sellers Brace for Impact as Fees and Scrutiny Mount

Amazon’s new low inventory fees have exacerbated seller frustrations amid growing antitrust scrutiny. Many sellers see it as the ecommerce giant leveraging its dominance to extract more revenue through mounting fees that now make profits extremely difficult. While Amazon tried appeasing backlash by reducing some other 2024 fees (read this article), sellers gained little meaningful relief. Despite legal allegations of monopolistic practices that disadvantage merchants, Amazon continues squeezing them harder.

Across the internet, outraged sellers expressed anger and distress over their precarious futures. The reactions encapsulate growing fears that Amazon prioritizes fattening margins through seller fees over viable independent businesses on its platform. This latest fee hike signals no relief in sight. We have selected some of the comments from the Amazon Seller Forum, that express the confusion and the worries surrounding this policy change.

One seller wrote:

“What happens to Seasonal products? Let’s say we come from a huge season in December, and we strategically lower our inventory in January as we sell not even a 10th of what we sell in December. This will force us to go into January with HUGE inventory numbers to avoid the fees or worse we will have to pay a fee for carrying the correct inventory.”

Doesn’t seem to be well thought across all the different scenarios.

Another one points the irony of the situation:

“Amazon wants us all to raise prices to absorb these new fees to delight amazon’s customers. As a customer on amazon I know I just love when prices are jacked up, and so now I shop more at wally website. Amazon also wants to give the FTC more proof of how amazon squeezes 3p sellers, because someone in corporate really thinks amazon is not likely to be paying enough fines in the lawsuit. It really is quite the genius move to jack up fees during the FTC lawsuit, and also drive sellers and customers away. I contacted support about these splendid plans and seller support said they cannot comment on any of this because it is not public knowledge so, public enough to be easily found on google, but not public enough for seller support to know anything about, other than the help files they like to copy/paste…

Let’s all give a round to applause to the genius who came up with the low inventory level fee that will help FTC in in court and end up driving away business on amazon… “

https://sellercentral.amazon.com/seller-forums/discussions/t/aa9f98e5-fa91-4949-af8f-6cf918c86a77

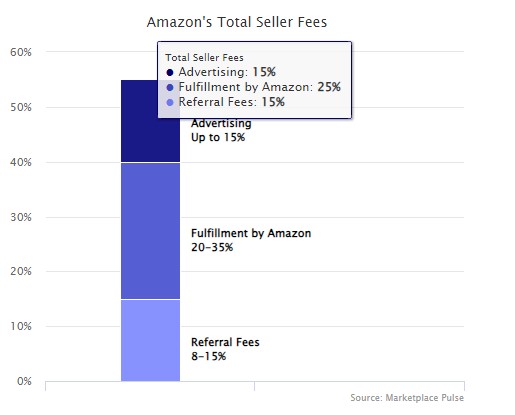

Fulfillment Fees – Cash Cow Funding Amazon’s Success?

It’s a complex love-hate relationship between third party sellers and the ecommerce giant Amazon. So, while FBA provides sellers with valuable benefits and enables them to stay competitive, Amazon can freely milk its fulfillment cash cow through fees sellers have little choice but to pay. This power dynamic spurs seller resentment but with no equivalent fulfillment alternative, they feel trapped, at the mercy of Amazon’s fees feeding its dominant platform. The impending low inventory fee will turn the screws harder for sellers that struggle already to make enough profit to survive.

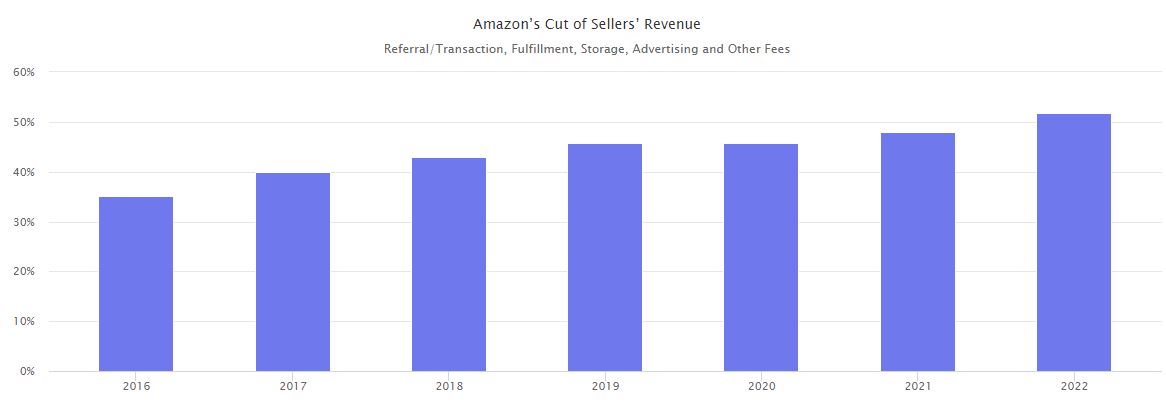

* The data from this graph shows how profitable Fulfilment fees have been.

*The ever-increasing cost of selling on Amazon leaped past 50% of total seller’s revenue in 2022.

Amazon offers seems to take a “carrot and stick” approach, compromising on certain fees while sharply increasing others like inventory. The coming months will prove informative as antitrust lawsuits unfold, determining if regulatory scrutiny can curb anti-competitive practices that disadvantage small businesses relying on Amazon, but sellers should refrain from drawing definitive conclusions yet. Indeed, fairer treatment likely depends on the outcomes of ongoing legal challenges to the e-commerce platform far-reaching grip over its marketplace. For now, sellers must navigate unpredictable waters as best they can, hoping calmer seas await on the horizon.

Click here to hear this article’s podcast version!

March 16, 2024

How will this affect used book resellers?