When is the Right Time to Automate Sales Tax?

As a business owner, you have to pick and choose where to spend your time. And as your business gets busier, your time grows more valuable.

One business hassle you can automate is sales tax. But how do you know the time is right? If any of these scenarios sound like you, it may be time to invest in sales tax automation.

There aren’t enough hours in your day

As your business grows, your time and attention become your most valuable resource. You can either spend time on value-adding activities that help your business grow, or spin your wheels working on unprofitable and time-wasting activities like sales tax.

Most business owners are required to collect and file sales tax. But you collect sales tax straight from your buyers and immediately send it straight back to your state department of revenue. Spending time on sales tax will never grow your business. It’s a hassle that takes you away from important activities that will help your business thrive. If you find the hours spent on sales tax reporting and filing are detracting from the time you could be spending on your business, it may be time to consider sales tax automation.

You’re constantly paying sales tax penalties and interest

It’s hard to get a handle on sales tax filing due dates, especially if you file sales tax in more than one state. First of all, you’ll be required to file sales tax either monthly, quarterly or annually depending on your sales volume. Then there’s the fact that different states require you to file your sales tax returns on different dates of the month. The majority of state sales tax return due dates fall on the 20th day of the month after the taxable period ends, but many states have sales tax due on other dates – like the 15th, the 25th, the 23rd, or the final day of the month.

As an online seller you may find yourself filing paying sales tax monthly on the 20th quarterly on the 25th and annually on the last day of the month. And states aren’t forgiving if you are late – they’ll charge you a set late fee plus interest on the sales tax you were late remitting. If you find yourself filing late and paying unnecessary penalties, it may be time to AutoFile your sales tax and let technology remember the due dates.

You get bogged down by small details

Sales tax is all about the small details. When filling out a sales tax return, most states require that you separate out how many dollars and cents you collected in each and every county, city and other special taxing district within a state. On top of that, many want you to round these numbers up or down. This can be a nightmare if you transpose a number or accidentally round your numbers in the wrong way. When you go to hit that “submit” button on your sales tax return, the state’s software will return a big red error and tell you to re-do your work. Ouch! If you’re more of a big picture person than someone who enjoys wrangling small amounts of money into tiny boxes on a state sales tax website, it may be time to try sales tax automation.

You hate filing sales tax returns!

You didn’t bravely strike out on your own just so that you could spend your time on tasks you hate. And if you are simply sick and tired of dealing with sales tax returns, why not buy back your time and peace of mind and automate sales tax? You’ll be glad you did!

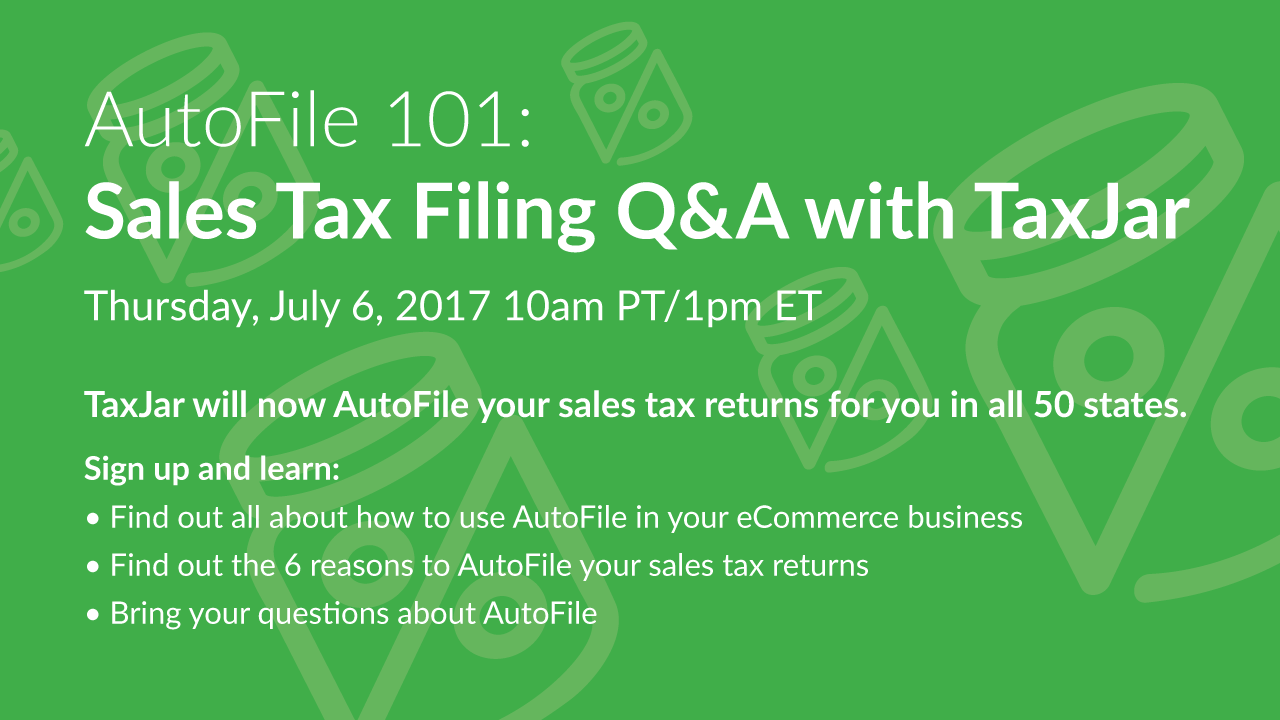

I hope this post has helped you determine if it’s time to AutoFile your sales tax returns. Do you have questions about sales tax automation? Join our upcoming “AutoFile 101: Sales Tax Filing Q&A with TaxJar” webinar for more info.

TaxJar is a service that makes sales tax reporting and filing simple for more than 8,000 online sellers. TaxJar now AutoFiles your sales tax returns in every state! Try a 30-day-free trial of TaxJar today and eliminate sales tax compliance headaches from your life!