Amazon New Placement Fee Debunked – Inbound Placement & Defect

Amazon’s latest fee updates, including the new Placement Fee and Inbound Defect Fee, have caused an uproar among sellers. If you are an Amazon seller, you are likely aware of the very controversial low inventory fees and return policy fees that have sparked widespread outrage in the seller community. These fees have been widely condemned as exorbitant, with most sellers criticizing Amazon’s sporadic fee updates from January to June 2024, making it increasingly challenging to keep track of the ever-changing costs. This year, it seems that Amazon has introduced fees for every aspect of selling on its platform, leaving sellers feeling nickel-and-dimed at every turn. In today’s article, we will delve into another controversial In Bound Placement Fee & Inbound Defect Fee and discuss the prospects for third-party sellers on Amazon’s marketplace.

What are the Inbound Placement Fees?

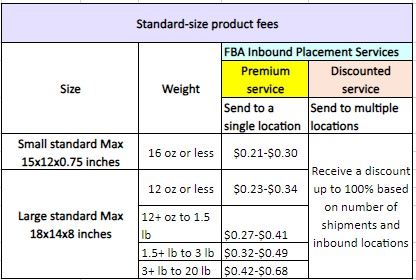

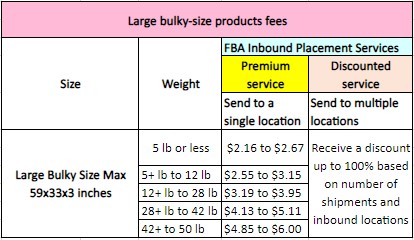

Amazon emphasized the importance of strategically positioning inventory across multiple fulfillment centers nationwide to ensure swift and cost-effective product delivery to customers. The e-commerce giant explained that the FBA inbound placement service fee for standard and oversized products is designed to cover expenses associated with distributing inventory to fulfillment centers close to consumers. Amazon has claimed that this fee adjustment, scheduled to take effect on March 1, 2024, is part of the company’s ongoing efforts to optimize its logistics operations and maintain competitive shipping capabilities.

How Much are You Going to Pay?

Accurately determining the financial impact of the new placement fees is likely to be a complex endeavor. Based on the info that Amazon shared, it is hard to determine the exact price of the fee. The cost will heavily depend on several factors, including the size and weight of the products, as well as the chosen fulfillment center location. Additionally, the fees will vary based on whether you opt for Amazon’s premium service or take advantage of the discounted service for sending inventory to a single location.

What are the Inbound Defect Fees?

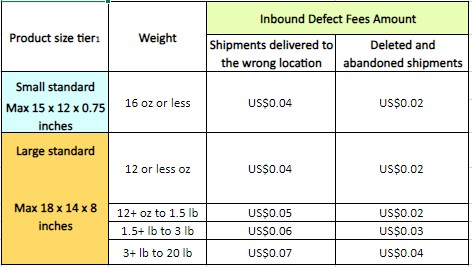

As if the challenges were not already mounting, sellers will also need to contend with the newly introduced Inbound Defect Fees. Now Amazon reserves the right to refuse shipments that fail to adhere to the Fulfillment by Amazon (FBA) shipment requirements. If we accept inventory that does not meet our shipping guidelines or deviates from your shipping plan, you may be subjected to inbound defect fees to cover the additional costs incurred for redirecting, receiving, and processing your shipment.

Inbound Defect Fees may be imposed for the following issues:

- Shipments delivered to the wrong location: Your shipment was sent to a different fulfillment center than the one listed in your shipping plan.

- Deleted and abandoned shipments: Your domestic shipments didn’t arrive within 45 days of shipment creation and your international shipments did not arrive within 75 days of shipment creation. In a multiple destination shipping plan, your additional shipments did not arrive within 30 days of the first shipment.

FTC’s Ongoing Investigations on Amazon

In the preceding year, the Federal Trade Commission (FTC) filed an antitrust lawsuit against Amazon, alleging the tech giant’s exploitation of its influence over sellers. This coincided with Amazon’s introduction of new fulfilment fees and modifications to seller fees in Q4, purportedly aimed at accelerating shipping speeds for customers while curbing associated costs. During the holiday quarter, Amazon sellers contributed over 60% of items sold on the platform, contributing to the company’s substantial $140 billion revenue solely from seller fees in 2023.

Recent reports indicate that the FTC is now scrutinizing a fresh set of fees imposed by Amazon on U.S. merchants. These fees include Inbound Placement fees, compelling sellers to either subscribe to a new Amazon warehousing service or independently dispatch goods to at least four warehouses to avoid charges. Additionally, the implementation of Low Inventory fees penalizes sellers for consistently maintaining insufficient stock in Amazon warehouses unless they enlist in Amazon’s new warehousing service, termed AWD (Amazon Warehousing and Distribution), designed to replace long-term inventory storage for sellers. Many sellers express concern that these intricate and costly fees seem geared towards coercing them into adopting Amazon’s fulfilment services, thereby relinquishing more control over their supply chain or potentially increasing prices for consumers on the Amazon platform.

Many sellers on Reddit have expressed frustration regarding the recent Amazon placement fees, noting that they now must cover both shipping costs and placement fees.

“This new “placement fee issue,” compounded by Amazon’s soon to charge low-inventory fees, will force us to pass on price increases to consumers.”

“I know someone posted this the other day, but this is ridiculous. What literally cost me just $30 in shipping a week ago, now is $30 + $239 placement fee. I sell mostly what was once considered “Small and Light” so rarely do we send pallets. I am curious, those who are shipping pallets what does this placement fee look like?”

Another one wrote directly on Amazon seller forum:

“These new inbound placement fees are completely ridiculous! We have 6 pallets ready to ship and these products used to go to FTW1, which is literally 5 miles away from our warehouse! Now Amazon is wanting us to split this shipment into multiple shipments and pay 4x the amount to send them all over the country.

So, instead we are moving away from FBA and going to ramp up our merchant fulfillment through our own 3PL services. It’s more profitable.

Amazon needs to eliminate these insane new placement fees immediately.”

This seller is talking about how these inbound fees became insane:

THIS IS INSANE! 100 units in one box, shipping is $14.95, placement fee is $230!!! NOT $23, but $230!! This is a Joke Amazon, there is no way we can survive. We won’t be able to ship anything until it is fixed.

https://sellercentral.amazon.com/seller-forums/discussions/t/bab0d58c-a48f-4cc5-b704-1cb742d57634

What is the Future for FBA Third Party Sellers on Amazon Platform?

One workaround involves applying for Merchant Fulfilled Prime, which allows a seller to store and ship their products on their own and still earn the Prime badge if they can hit a strict threshold of delivery performance. Sellers may also avoid the low-inventory fees by handing Amazon more control of their supply chain and utilizing the AWD service for long-term inventory storage.

Now, the question remains: How long can third-party sellers sustain their operations on Amazon in the face of these destabilizing practices, and how will the FTC respond to these actions, which impact both sellers and customers? As Amazon continuously adjusts its fee structure throughout the year, sellers face mounting challenges in accurately predicting the financial ramifications of the latest fee updates. The effects of these changes are not immediate but rather manifest gradually over time, compounding the difficulty for sellers to gauge the full impact on their bottom line.

Amazon appears determined to introduce additional fees across various aspects of its platform, potentially driving many sellers to abandon the Amazon FBA program. Despite being under the scrutiny of the FTC since last quarter, Amazon continues to squeeze third-party sellers with ever-increasing fees that erode profit margins.

Beyond the new inbound placement fees, on April 1 Amazon will also begin charging most sellers a fee if they don’t consistently have four weeks of inventory in Amazon fulfillment centers. One caveat though is that Amazon also charges sellers for storing too much inventory in Amazon facilities.

Ultimately, the fate of third-party sellers on Amazon may hinge on the e-commerce giant’s willingness to reconsider its approach. A mass exodus of sellers in response to these excruciatingly high fees remains a possibility, but the outcome will depend on Amazon’s actions moving forward.

Click here to hear this article’s podcast version!