EU VAT Invoice Introduction for EU Sellers

Our last VAT article introduced VAT rules for Amazon US sellers who sell in Europe; this article will focus on the VAT regulations that Amazon EU sellers must comply with. If you are based in a European State and sell on any of the Amazon EU marketplaces, the following is information about VAT that you should be aware of.

United Kingdom:

In the UK, if your VAT taxable turnover exceeds £83,000 in the past 12 months, you must register VAT number with HM Revenue and Customs(HMRC). Also, if your turnover falls below the £83,000 threshold, but is expected to exceed it in the next 30 days, you should apply for VAT number as well. You can easily register online at Register for HMRC taxes. Once you register for a VAT number, you are obligated to submit a VAT fee to HMRC every 3 months. Although there are multiple VAT schemes, the most two common ones that Amazon UK sellers apply for are flat rate scheme and standard scheme.

Flat rate scheme

The flat rate scheme allows sellers to collect an amount of their gross turnover with a fixed flat rate percentage and submit to HMRC. Different types of business have different fixed-rate percentages. You can visit VAT Flat Rate Scheme to check the rate percentages for your products. Also, if you are in the first year of VAT registration, you can enjoy a 1% off the flat rate. For example, if the flat rate for your product is 7.5% initially, it would be 6.5% for your first year.

The benefit of this scheme is that it is simpler for you to calculate and record. However, not every business is eligible for it. Only business with turnover below or equal to £150,000 in the next 12 months are eligible to apply and adopt the flat rate scheme. In addition, if the total value of its income is above £230,000 for the past 12 months on the anniversary of your joining, or you expect it to get to that amount in the next 12 months, you will lose the qualification to use this scheme. Moreover, as the amount you submit to HMRC is calculated by a fixed rate percentage of your turnover, you cannot claim back VAT from your inventory purchase.

To use this scheme, you can simply apply online at the same time when you register for VAT number, or anytime afterwards. If the time you apply for it is close to the time of VAT registration, you can begin to use it starting from the date of VAT registration. Otherwise, you would have to wait for HMRC’s approval notification and the date for the scheme to start. You would still have to issue VAT invoice and notably, you should use the normal VAT rate when calculating VAT on the invoice.

Standard scheme

As long as you have registered for VAT number, you can join this scheme. Or, if you are using the Flat Rate Scheme but your turnover has exceeded £230,00, you should switch to the standard scheme. The rationale of this scheme is simple, which is to charge VAT based on your sales. Currently the standard VAT rate is 20% while the reduced rate is 5% in the UK. You can go to VAT rates on different goods and services to check the rate for your goods.

Germany:

In Germany, if your VAT taxable turnover exceeds €17,500 in the past 12 months, you will have to register VAT number with the German government. If your annual turnover did not exceed €17,500 in the preceding calendar year and is predicted not to exceed €50,000 in this calendar year, you are classified as small Entrepreneur (Kleinunternehmer). That means it’s not imperative for you to register VAT number. Currently the standard VAT rate in Germany is 19%, which is for most services and goods while the reduced rate is 7%, which is for food and books.

If you just registered German VAT, you have to submit VAT every month to the German government for 2 years. If you have registered VAT for longer than 2 years and your annual tax income is below €1,000, you only have to submit VAT annually. If the tax income is between €1,000 and €7,500, you are supposed to submit VAT quarterly. If it exceeds €7,500, then you are obligated to submit monthly again. Usually the filing of German VAT should be due on the 10th of the month in the end of the period. However, there is a three-day buffer. That is to say, the VAT must be sent to the tax office no later than 14th.

France:

Currently there are two standard VAT rates for different categories in France. The standard VAT rate is 20% for most services and goods and the reduced rate is 7% for food and books.

The amount of your annual turnover determines which VAT scheme is applicable to you and how you declare VAT in France. If your annual turnover does not exceed €82,800, you are “micro-entrepeneur” and are exempt from paying VAT. Otherwise, there are 2 schemes – Réél Simplifié d’Imposition (RSI) and Réél Normal (RN).

If your annual turnover does not exceed €788,000 and the VAT amount to be declared is less than €15,000, you can benefit from the Réél Simplifié d’Imposition (RSI) scheme. The RSI scheme allows for paying the previous year’s VAT in two installments – 55% in July and 40% in November. You are exempt from paying the installments if the VAT due for the previous year is less than €1,000. In this case, usually the filing of France VAT is due on May 1st and there is a 2-day grace period.

If your annual turnover exceeds €788,000 or the VAT amount you declare is more than €15,000, you are on the Réél Normal (RN) scheme, which requires you to declare and pay VAT every month. You can declare VAT quarterly if the VAT due is less than €1,000. Companies on this scheme must declare the VAT due for the previous month and pay it at the same time directly on-line via their tax account or through a service provider.

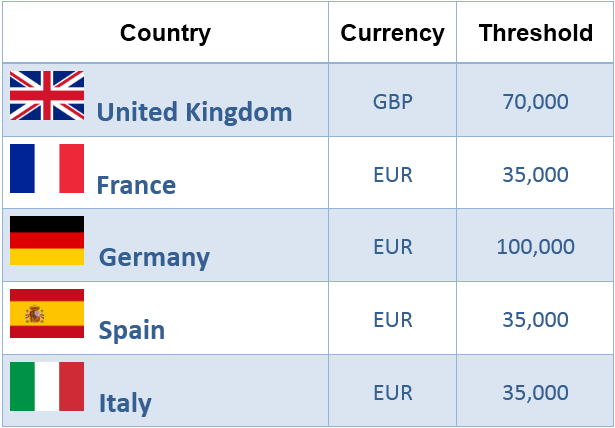

Distance Selling Threshold:

If you are selling not only in the country that your business is located but also other Amazon EU marketplaces and your sales in one of those marketplaces in any continuous 12 months has reach the distance selling threshold, you are obligated to register VAT numbers and pay VAT to that country. For instance, if you sell both on Amazon UK and DE and your inventory is stored in the UK, you only have to register VAT number in the UK if your sales reach UK’s domestic threshold, £83,000. However, if your sales in Germany exceeds Germany’s Distance Selling Threshold, you must register and submit VAT to the German government.

As aforementioned, the thresholds vary from each European country. The following chart provides a quick reference for the thresholds for 5 Amazon EU marketplaces:

Amazon’s Fulfillment:

There are two Amazon fulfillment methods for FBA sellers to distribute their goods to Amazon EU marketplaces – European Fulfillment Network(EFN) and Pan-European FBA.

Amazon’s European Fulfillment Network (EFN) provides Amazon sellers a convenient entrance into EU marketplaces (UK, DE, FR, IT, ES) with one centralized account. It allows sellers to ship their inventory to an Amazon Fulfilment Centre in Europe. Then, when there’s a European order, Amazon will dispatch and deliver the product to the EU customer in a short period of time. If you adopt this method, you won’t have to register VAT number in other European countries unless your sales in that country reach the Distance Selling Threshold.

On the contrary, if you choose Pan-European FBA, your inventory will be shipped and stored in different fulfillment centers across Europe, which can lead to faster delivery and higher customer satisfaction. However, by keeping your stock in multiple Amazon warehouses in different European countries, you cannot take advantage of the Distance Selling Thresholds. You are liable to register VAT numbers and pay VAT to all these countries where your inventory is stored. The process would be more complex due to the variation of VAT rates and regulations in different European countries. Moreover, it might reduce your profit margin because of the VAT expense.

VAT Invoice:

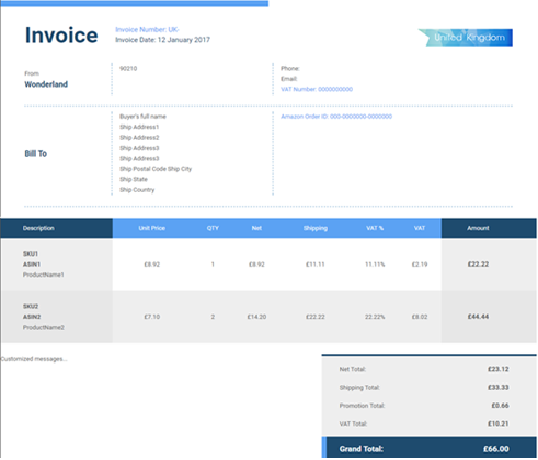

In the UK, once you registered VAT number, you are obligated to issue VAT invoices to your customers regardless of the rate scheme you’re on. Normally you should send a VAT invoice to your customer within 30 days after the order placement date. You can choose to issue VAT invoices in either paper format or electronically.

Here is the template of VAT invoice that BQool provides.

Now you know the regulations of EU VAT. As for issuing VAT invoices, BQool can take care of the hassle of these tedious tasks. Check out EU VAT Invoice Generator to learn more about how our tool helps free up your time to focus on more important aspects of your business!