EU VAT Invoice Generator is available now!

Are you selling on Amazon EU marketplaces and find it a hassle to issue VAT invoices with different VAT rates? We have a great news! BQool is excited to introduce our new feature in Feedback Central― EU VAT Invoice Generator!

What is VAT and why is VAT invoicing important?

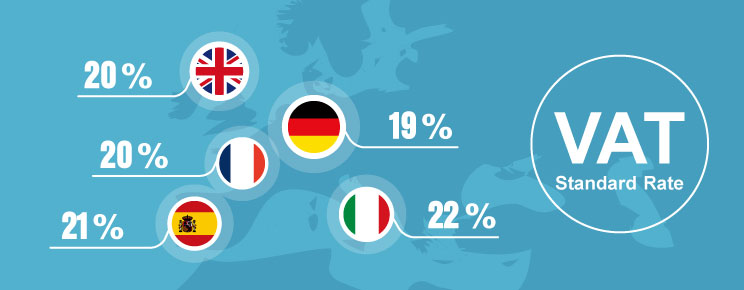

According to Amazon’s policy, “Amazon is obliged to charge VAT on all orders delivered to destinations in member countries of the EU. VAT is charged in accordance with the local legislation in each member state.” [1]

In many European countries, customers would expect sellers to provide VAT invoices along with their orders. For instance, in Germany and Italy, buyers often request VAT invoices for high-valued items. In addition, if a customer makes a purchase on business expense, he/she will need a VAT invoice in order to claim back the VAT from the government.

Issuing VAT invoices is crucial for EU marketplaces sellers, but Amazon does not provide automatic invoicing tools in seller central. Sellers have to create the template, type in buyer’s info and calculate the VAT rate manually, which can be an arduous task. That is where BQool’s new EU VAT Invoice Generator comes in handy!

How does BQool EU VAT Invoice Generator work?

Multiple templates

BQool EU VAT Invoice Generator feature comes with multiple beautifully designed invoice templates for you to choose from. Simply pick the one you like, enter your company name, contact information, upload your store logo, and you are ready to go!

Set up different VAT rates for various scenarios

The complexity of VAT is that the actual rates applied vary between EU Member States and between certain types of products. (Related article: How to Sell Globally on Amazon Across European Marketplaces) Normally, sellers have to register VAT number and to pay VAT to the countries where their business are base. However, if their sales exceed “Distance Selling Threshold“ in other EU countries, then they are obligated to register for VAT numbers and pay VAT in those countries.

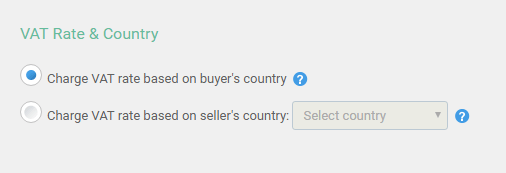

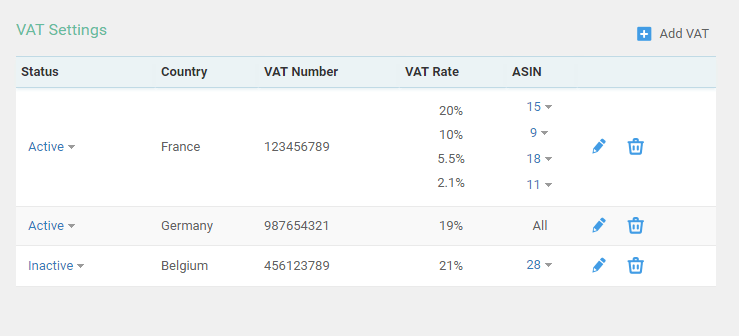

In order to accommodate different scenarios, you can select the VAT rate by buyer’s country or the country where your business is based. Under BQool’s VAT settings, you can add a country, your VAT number, different VAT rates for different product categories and the ASINs in each category.

Additional invoicing options

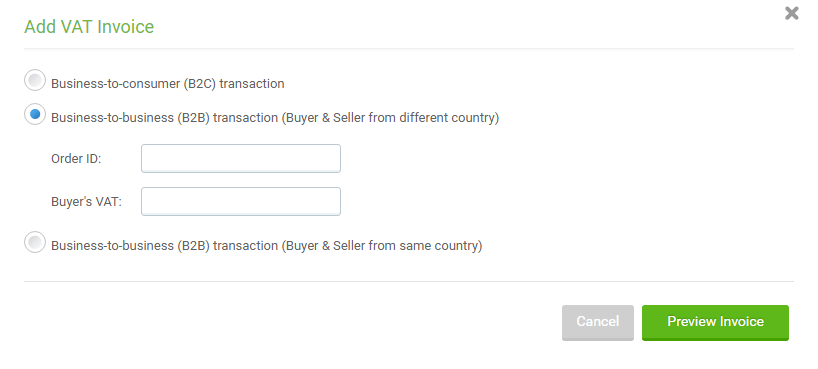

BQool EU VAT Invoice Generator offers advanced invoicing options in which you can choose to send VAT invoices to all EU buyers or only FBA/FBM buyers. In sales orders cases where the buyers are also VAT registered companies, you can manually add their order ID and VAT numbers.

Even though VAT invoicing is complex and time-consuming, but as long as your EU VAT Invoice Generator feature is set up correctly, Feedback Central can do it for you automatically! If you’d like to learn more about how to use this feature, please check our tutorial video. EU VAT Invoice Generator feature is available starting on $50+ plans. Sign up for your 14-day free trial and see how Feedback Central can help make your VAT invoicing a breeze!