Amazon Return Policy in 2025 (Latest Update)

Amazon has recently made a major announcement that will significantly impact third party sellers: changes to returns processing fees set to take effect in 2024. The new policy will be implemented in three phases from February to June, shifting costs back to sellers who are already facing slim profit margins. This is just one of many 2024 fee changes affecting third party sellers on Amazon. In this article, we will discuss the latest return policy measures introduced by Amazon and provide tips on how sellers can adapt their business strategies.

Navigating Amazon’s 3-Step Returns Policy Transition

Following other Amazon policy updates this year, the eCommerce giant is gradually rolling out returns processing fee for the new returns policy. First implemented on February 5th for shoes and clothing, Amazon will provide more details in May on category-specific return rate thresholds used to determine fees. The policy will fully take effect on June 1st across all categories. Amazon states “address the operational costs of returns and reduce waste”. The fee applies to items exceeding return rate thresholds for each product category. A product’s return rate is calculated as the percentage of units shipped in each month that are returned over that month and the next two calendar months. For example, the return rate for June 2024 shipments covers returns through August 2024. Beyond the threshold, the fee is charged per returned unit.

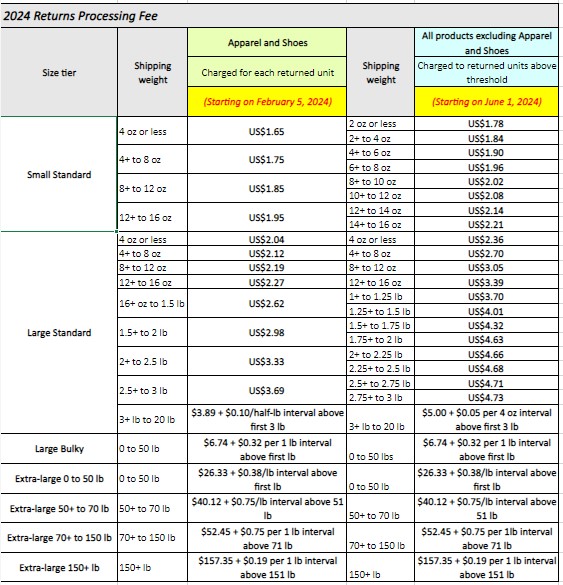

Here is the table that illustrates the latest return Amazon Policy and the latest info:

For clothing items, processing fees have been reduced to between $0.30 – $0.50. A returns processing fee is charged for each returned unit of Apparel and Shoes products without any thresholds, fees are charged as returns occur. All other categories except for apparel and shoes have a threshold for return.

We recommend you check the FBA Returns dashboard weekly starting May 1, 2024, to avoid unpleasant surprises.

For example, for June 2024’s shipped units that are returned and are charged a fee, the charge will be made between the 7 to 15th of September 2024. Returns for products shipping less than 25 units a month are exempt. The New Selection program waives fees for up to 20 units per eligible ASIN. Thresholds will be announced in May 2024.

Amazon has not yet come up with the threshold we will need to wait until May 2024 to get threshold revealed. Finally, you can access summaries of your return fees in the various fee management tools at your disposal, such as SKU Economics. The fees will also show up on your monthly Seller Central payment report once the charges have been applied.

Illustrative Example of How Amazon will calculate Processing Fees

For example: 1,000 units of a product were shipped to customers in June 2024. In June, July, and August 2024, 120 of the 1,000 units shipped were returned. The returns threshold for this example product category is 10%*, so returns that exceed 100 units (10% of the 1,000 shipped) during the shipment month and subsequent two months will incur the returns processing fee. In this case 120 units were returned, so 20 units would be charged the returns processing fee.

How can I avoid Having too Many Returns?

While there is no guaranteed way to completely avoid Amazon’s high return fees, certain categories and products, such as clothing and shoes, are more susceptible to returns. Providing detailed product information to customers can help reduce returns.This article shares useful tips and best practices for sellers to implement to help reduce return rates.

Amazon’s new returns policy will roll out over the coming months, bringing significant changes in fees for sellers. It’s important for sellers to closely track the updated category-specific return rate thresholds that will be revealed in May and implement best practices to minimize returns. We will continue sharing the latest official updates to keep sellers informed through each phase of changes in 2024 and beyond!

**Latest Update **

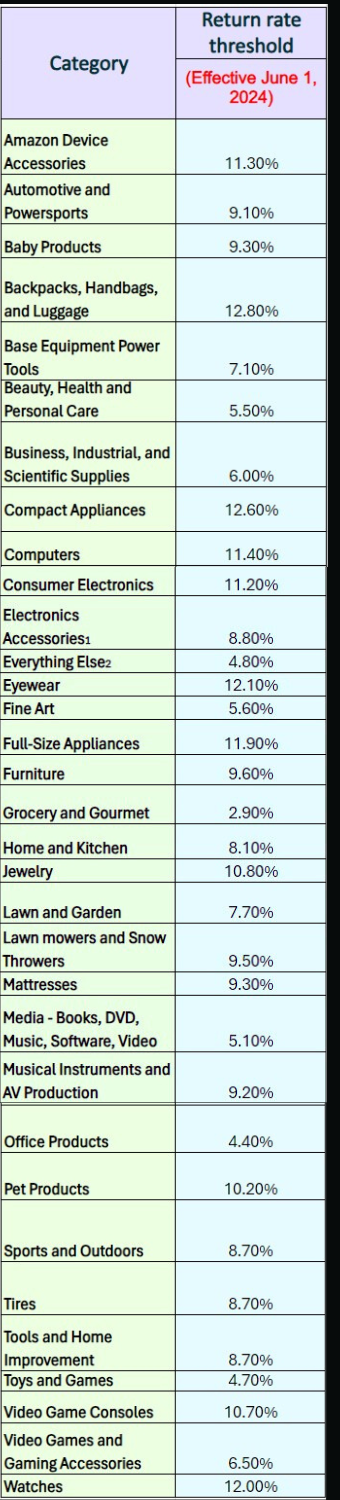

Here is the threshold that will apply for each product category on Amazon:

“Amazon audit fee categories periodically and update them. The return rate threshold applied to the high return rate fee for a particular month is based on your product’s fee category at the end of the three calendar months measurement period. What can we say about this return policy? Fees will be impacting all the categories, not just clothes and apparel starting on June 1st. “

How will Returns Policy Impact Sellers after Major Sales Event like Prime Day, Black Friday & Cyber Monday in 2024?

With the implementation of return fees across all categories this year, the potential impact on sellers post-Prime Day remains uncertain. While Prime Day, Black Friday and Cyber Monday are known as the largest sales event of the year, like any successful event, it comes with its share of drawbacks, such as an increase in returns. The updated return policy introduces new considerations for sellers, potentially posing challenges and impacting their bottom line.

Let’s Talk About Facts!

One prevailing viewpoint that resonates with many individuals is the belief that the fee adjustments primarily target small sellers with poor logistic management practices, who sell low-quality products sourced at cheap prices on Amazon. According to this perspective, the changes are seen as a positive development that will allow successful sellers to surpass competition on the platform.

On the other hand, Amazon has faced scrutiny from the FTC, leading to a lawsuit filed against the ecommerce platform in September 2023. The allegations focus on claims of unfair competition directed towards third-party sellers. For more details on the ongoing lawsuit, you can refer to this article.

Our focus is not on determining who is right or wrong, but rather on visualizing the future of third-party sellers on a platform that appears to be increasingly uncertain. Despite some sellers believing that only small sellers will be impacted, we must consider who will be affected once the small sellers are no longer on Amazon. Will these confident sellers face the same challenges next?

If you want to learn more about how to calculatre return and refund on Amazon, click here.