Amazon Accounting II: How to Calculate Refund and Return Cost?

With the holiday shopping season coming to an end, you are probably going to deal with some returns and refund in Q1 next year. No one likes to see losses in businesses but returns and refunds are as unavoidable as tax. The best way to minimize the impact of returns and refunds is to understand their associated hidden costs and how they may affect your business revenue.

For this reason, we have some great tips to help you analyze the data from your profit and loss statement and explain to you what fees, taxes and cost you must include into your cost calculations so you would know the hidden costs that are eating away your profits.

Let BQool walk you through refund and return cost calculation one step at a time and teach you how to quickly calculate all the costs on a spreadsheet like a pro.

I. Fees, Taxes & Costs Overview

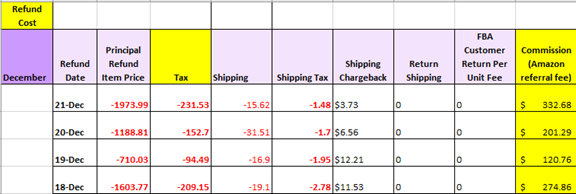

Every Amazon seller should have a detailed record of their total costs, there are a lot of different values that you need to consider in your calculation. There is a logic that everyone should understand is that when you calculate profit, the sales made from that item is a positive value and the cost associated with the sales (i.e., Tax shipping) will be a negative value. However, those values would be in reverse when you calculate refund and return.

Refund Item Price: Amount that the seller refunded to the customer for an item.

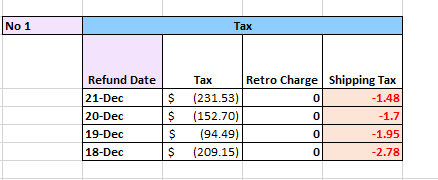

Tax: We calculate the Tax as followed:

Tax + Retro Charge (ex. Partial Refund) + Shipping Tax

This tax is the basic tax that applies to all goods. Then, the amount could vary according to the place (states or country) and the category of the goods (food, clothes etc.)

Shipping: This amount that the seller refunded to the customer for shipping back the item(s) to the warehouse.

Shipping Tax: The amount based on the shipping amount and refunded to the customer.

Shipping Chargeback: This Amount that Amazon refunded to the seller for shipping. This amount is a refund.

Return Shipping: The amount given to the buyer to compensate for shipping the item back to Amazon in the event Amazon is at fault.

FBA Customer Return Per Unit Fee: The returns processing fee only works as a reference for Apparel. Jewelry, Sunglasses, Watches, Handbags & Luggage, Shoe categories.

Commission (Amazon referral fee): The referral fee is a fee Amazon charges you every time you sell a product. It is a percentage of the total sales price and is usually 15%. The percentage varies based on the product category and can go as low as 8% (for computers) and as high as 45% (for Amazon Device Accessories).

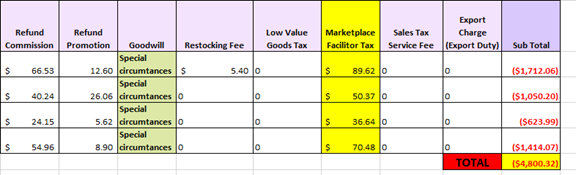

Refund commission (Refund Administration Fee): This fee is related to administrative handling. When a refund is issued, the fee charged against the original fee amount is refunded.

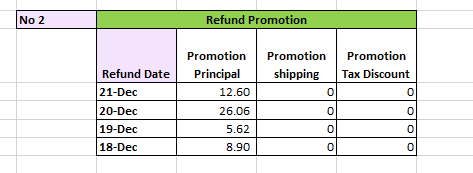

Refund Promotion: It is the return calculated on the discount amount.

Refund promotion is calculated as: (Promotion Principal) + (Promotion Shipping) + (Promotion Tax Discount)

Goodwill: This amount is based on concessions. The seller can decide to give extra compensation to the customer in case the buying experience has generated pain.

Restocking Fee: The amount that Amazon charges the buyer when returning a product in certain categories. Amazon might charge customers a Restocking Fee for returns that are not eligible for a full refund. Amazon reports this adjustment to the customer’s refund as a seller credit.

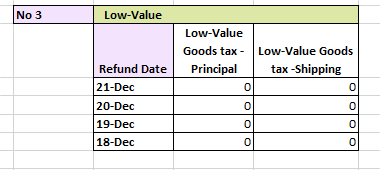

Low Value Goods Tax: Collected when the customs value is equal to or less than a certain amount.

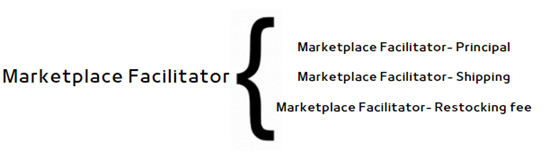

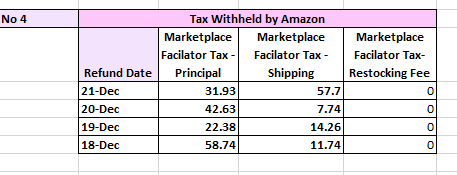

Marketplace Facilitator Tax: it is a tax collected by Amazon on your behalf and then remit to the

State.

Marketplace Facilitator is divided in 3 parts for calculation:

- Marketplace Facilitator Tax_ Principal: The tax withheld by Amazon on the Principal.

- Marketplace Facilitator Tax_ Shipping: The tax withheld by Amazon on the Shipping Charge.

- Marketplace Facilitator Tax _Restocking Fee: The tax withheld by Amazon on Restocking fees.

Keep in mind that all selling transactions are contracts even if there’s not explanations, when you sell something and the customers buy, they agree with you and Amazon on purchase terms.

We calculate Marketplace Facilitator Tax as followed:

(Marketplace Facilitator Tax-Principal) + (Marketplace Facilitator Tax-Shipping) + (Marketplace Facilitator Tax-Restocking)

Sales Tax Service Fee: If you use the tax calculation services, you will pay to Amazon 2.9% of all sales and use taxes and other transaction-based charges. These fees will be retained in the event of any refund on related transactions.

Export Charge (Export Duty): the export duty that is charged when Amazon ships an item to an international destination as part of the Amazon Global program.

Once you have extracted all the data from your profit & loss statement, you can add and subtract the values in an excel spreadsheet to work out the total cost as followed:

Total Cost:

Refund Item Price + Tax + Shipping + Shipping Tax + Shipping Chargeback + Return Shipping + FBA Customer Return Per Unit Fee + Commission + Refund Commission + Refund Promotion + Goodwill + Restocking Fee + Low Value Goods Tax + Marketplace Facilitator Tax + Sales Tax Service Fee + Export Charge

II. Using our Software BigCentral to Identify the Return and Refund Items

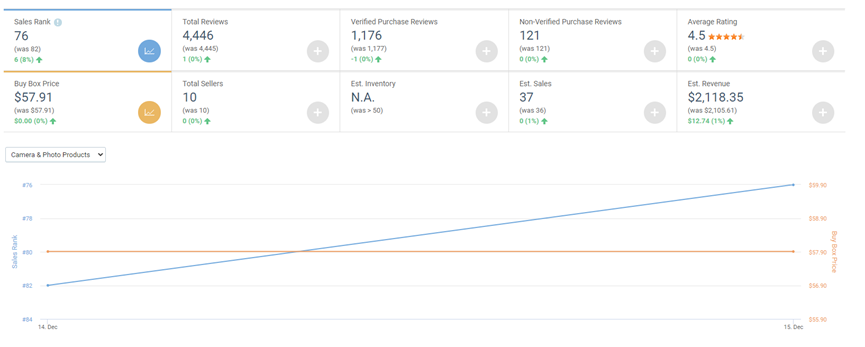

If you do not want to deal with the calculations yourself, we suggest you utilize a tool like BigCentral to help you analyze the return and refund items.

If you are also looking for some tips to provide an excellent customer service to prevent from returns, we have written some articles to give you tips to prevent from returns.

To summarize, BQool’s BigCentral helps you identify products with high return rate faster. You can identify issues with the product from the reviews and customer tickets. Then you can prepare a strategy based on the information you have collected and make improvements to your product. Maybe you will need to inform your supplier if the problem is related to malfunction etc.

We will give you more details in the next chapter – Calculation of the Advertising Cost and Promotion Cost.

Amazon Accounting Series✨

🔗 Amazon Accounting I: How to Tell If Your Amazon Business Is Profitable?

🔗 Amazon Accounting III: How to Calculate the Reimbursement?

🔗 Amazon Accounting IV: How to Calculate the Advertising & Promotion Cost?

🔗Amazon Accounting V: How to Calculate Amazon Fees?

July 12, 2022

Thanks for breaking this down! Super helpful.