Amazon Accounting I: How to Tell If Your Amazon Business Is Profitable?

The holiday season is quickly approaching. While you are busy preparing for a profitable Q4, it’s also time to go through your profit and loss report and sales performance to see if your Amazon store is making money. In this article, we will show you how to measure the performance of your Amazon business and provide you with the best practices for quickly calculating your profit by analyzing a profit and loss report.

Key Indicators to Determine Whether Your Amazon Business is Profitable

Your profit and loss report includes so much financial data, but you should pay more attention to indicators such as sales revenue, cost of goods, operating expenses, profit margin, and net income. All these elements are integral parts of an income statement, also known as a profit and loss statement.

1. Sales Revenue

Sales are usually referred to as income your business generates from selling the goods and services to customers. Sales revenue drives business success, and this is why every business owner always strives to figure out the best way to increase sales to build a profitable business.

We already provided a detailed section with the applicable formulas to help you calculate on your own the sales revenue of your business.

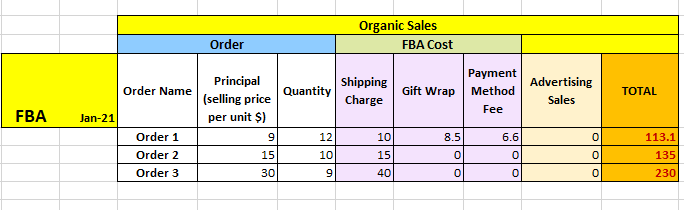

Explanations:

We have separated into 2 tables the organic sales and the tax sales. Keep in mind, there are a lot of elements you need to take in consideration with Amazon in your calculation. Last thing, the formula could change based on your vendor status (FBA or FBM).

-

Organic Sales

FBA: Principal – (Shipping Charge + Gift Wrap + Payment Method Fee) – Advertising Sales = Organic Sales

FBM: Principal + (Shipping Charge + Gift Wrap + Payment Method Fee) – Advertising Sales = Organic Sales

If you are a FBM seller (Shipping Charge + Gift Wrap + Payment Method Fee) would be added positively to the sales however if you are a FBA seller you have to deducted the FBA fees from your sales, it will be negative.

-

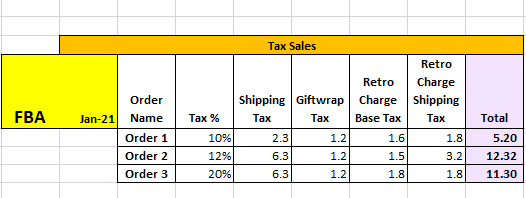

Tax Sales

The second table is related to the tax sales.

Amazon has a lot of different taxes that you must add in your calculation to know the right sales revenue.

The formula we have used here is: Tax + COD Tax + Shipping Tax + Giftwrap Tax + (Retro Charge – Base Tax) + (Retro Charge – Shipping Tax)

As we explained before the tax rate changes according to your vendor status.

-

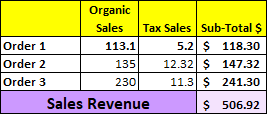

Sales Revenue

Finally, the Sales Revenue is the addition of the organic sales and tax sales.

2. Direct Cost

Direct cost is also known as cost of goods, which includes the cost of purchasing the products from suppliers, raw materials used, inbound and outbound shipping costs, and any costs directly attributed to sales generation.

Direct costs are typically variable costs and it’s a price that can be directly tied to the production of specific goods you sell, meaning they fluctuate with production levels such as inventory.

3. Overhead Expense (Indirect Cost)

This is what you expend on your business not directly attributed to creating a product, including facility rent, utilities, insurance, repairs and maintenance, payroll, business travel, corporate business tax, seller tools, warehouse costs, and everything included in your overhead expense allocation. Even though these costs help to grow your business and might increase as your sales grow, they are not directly related to the number of sales your company makes. For example, paying for Amazon storage fees will not directly increase sales, but you need space to store your inventory in order to keep your business operational.

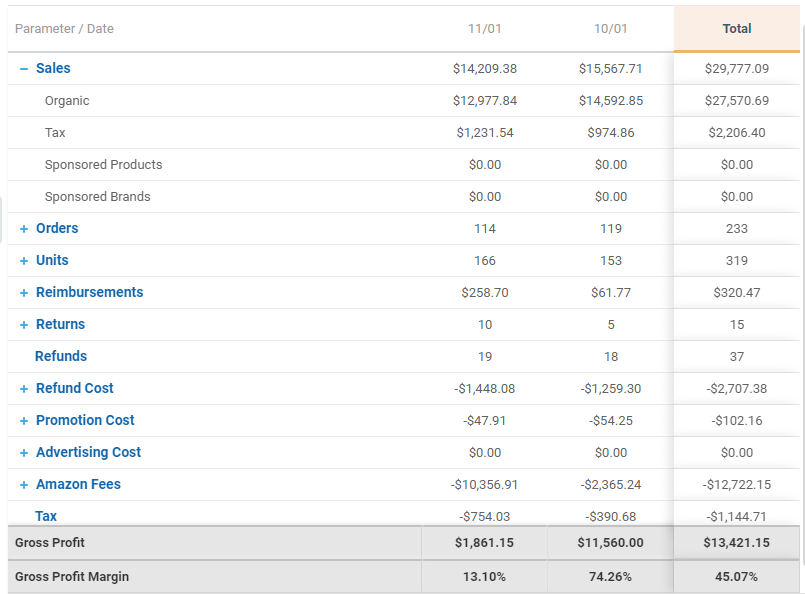

4. Gross Profit/Gross Profit Margin

Gross profit is your sales revenue minus direct costs, and to find the gross profit margin, you can use the following formula:

Gross Profit Margin = [(Total Revenue – COGS) / Total Revenue] X 100

If your business’s gross profit margin is 40%, or 0.40, this means you make 40% on every item you sell.

5. Net Income

Net income is your gross profit minus overhead expenses. Ultimately, it’s a key profitability indicator to determine how efficiently companies make money.

These are the numbers where you can find in a financial statement to analyze and monitor the overall financial health of your business. However, selling on Amazon requires you to pay Amazon seller fees such as monthly subscription fees, referral fees, FBA fees, storage fees, commission, etc., some selling expenses like advertising cost, promotion discount, return-related costs. Sometimes, you receive some reimbursement for damages and loss from the Amazon warehouse. These financial activities and information can get you overwhelmed.

It is important to know the fees associated with selling on Amazon so that you can have a full understanding of the costs and identify whether your business is making money or not.

How to Get Rid of Manual and Time-Consuming Profit Calculation and Creating P&L Reports?

Calculating profits manually for your Amazon business is time-consuming and is prone to human errors. With BQool’s BigCentral Profit Dashboard, all your store’s sales and cost data are automatically calculated and displayed in a single overview that provides a detailed view of business profitability. Profit Dashboard turns your reporting data into actionable insights that you can easily compare current and historical performances to spot trends for sales forecasts. Furthermore, the profit dashboard also provides a set of product performance ranking lists so that you can make the adjustments in your business strategy and allocate your resources appropriately.

Amazon Accounting Series✨

🔗How to Calculate Refund & Return Cost Step by Step?

🔗 Amazon Accounting III: How to Calculate the Reimbursement?

🔗 Amazon Accounting IV: How to Calculate the Advertising & Promotion Cost?

🔗Amazon Accounting V: How to Calculate Amazon Fees?

Don’t waste time creating a profit and loss report yourself. Let BigCentral handle it for you. Start your 14-day free trial and get instant access to your visual and comprehensive P&L reports with Big Central now.