Amazon Accounting V: How to Calculate Amazon Fees?

Selling on Amazon offers a lot of advantages to sellers, like improved brand visibility online and better customer reach across multiple marketplaces. While you sell your products on Amazon, you need to pay for fees especially if you have subscribed to FBA program.

As you may have noticed, Amazon offers different services, programs that you can choose to opt in to help you run your online business.

However, sometimes these services and programs that you are paying for could result to a hefty expense for your business and Amazon may end up costing you more money than it brings in.

In this article, we will explain what is included in the amazon fees and how to deduct the expenses from your gross profit so that you know if your business is profitable.

The Costs You Must Absolutely Understand

Based on what you are selling on Amazon, the fees would be different. You must take in account:

- Referral Fees (varied from categories)

- Nature of the Product (Multimedia, clothes)

- Dimensions

- Weight Handling

- Pick & Pack

If you want more information concerning FBA fees, you can check this page with all the FBA fulfilment fees products’ criteria.

Don’t forget to include any tariffs or customs fees if you import products, since those costs aren’t Amazon fees but still affect your bottom line

What is included in the Amazon Fees?

First thing you must do is to understand what your costs are. Indeed, there’s different categories and different costs that you must take in consideration to run your business properly on Amazon..

You can also have additional costs due to administrative service fees or stock management fees.

This is the detailed list of the fees you can find on your profit and loss statement:

Table of Content

FBA Inbound Transportation Fee

1)Added Value Service

Giftwrap

Giftwrap charges for Amazon fulfilled units are part of your gross sales proceeds. Amazon reports them to you as revenue and charges you a Giftwrap – Chargeback fee equal to the amount charged to the customer.

2) Shipping

Shipping

Shipping charges for Amazon fulfilled units are part of your gross sales proceeds. Amazon reports them to you as revenue and charges you a Shipping – Chargeback fee equal to the amount that you charged the customer.

3) Fees

Per-unit fee charged to compensate Amazon for the cost of fulfilling.

FBA Weight Based Fee

This is the fee that Amazon assesses for FBA sellers on a per-item basis to compensate Amazon for the cost of shipping per order.

FBA Transportation Fee (Multi-Channel Fulfillment Weight Handling).

This is the fee that Amazon assesses for FBA Multi-Channel Fulfillment to cover the costs of shipping per order.

Fee charged against the value of the item

Fixed/Variable Closing Fee

Variable Closing Fee _ Closing Fees

Fixed Closing Fee_Per-item fees for Individual Sellers

For Books, Music, Video, and DVD (BMVD). Variable closing fee charged for the sale of an item.

The fixed closing fee applies to individual sellers; Amazon retains the $1.80 fixed closing fee.

Monthly subscription fee

Monthly paid services fee. They refer to special advertisement such as DSP and marketing strategy.

Sales Tax Collection Fee (Tax Calculation Services Fees)

Storage Fee

◆FBA Inventory Storage Fee

◆FBA Long-Term Storage Fees

Storage fee for seller’s items stored in Amazon’s warehouse.

Calculated as: FBA Storage Fee + FBA Long Term Storage Fee

Fee for FBA Inventory Disposals

Fee for FBA Inventory Removals

FBA Inbound Transportation Fee

Terminology Explanations:

FBA Inbound Transportation Fee: FBA Amazon-Partnered Carrier Shipment Fee/ Inbound Transportation Charge

FBA Inbound Transportation Program Fee: FBA Inbound Transportation Program Fee

4) Taxes

Low Value Goods Tax

Collected when the customs value is equal to or less than a certain amount.

We calculated as followed:

Low Value Goods Tax-Principal + Low Value Goods Tax – Shipping

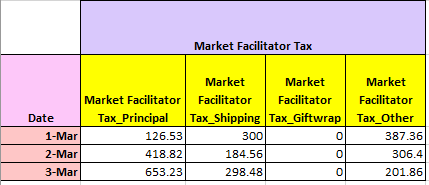

Marketplace Facilitator Tax

Terminology Explanations:

Marketplace Facilitator Tax – Principal – The tax withheld by Amazon on the Principal.

Marketplace Facilitator Tax – Shipping – The tax withheld by Amazon on the Shipping Charge.

Marketplace Facilitator Tax – Other – The tax withheld by Amazon on other miscellaneous charges.

Other Fees

Other fees refer to extra fees that you may pay if a mistake occurred. It is possible that Amazon did not charge you for the right amount and after checking charged you with additional fees.

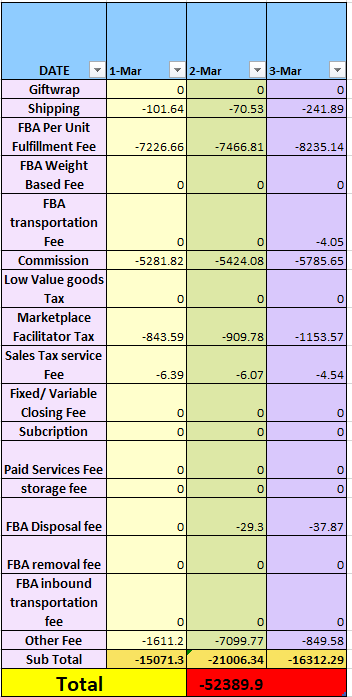

How to Calculate Amazon Fees?

We have calculated the Amazon fees as followed:

How to Calculate Tax, Gross Profit & Gross Profit Margin?

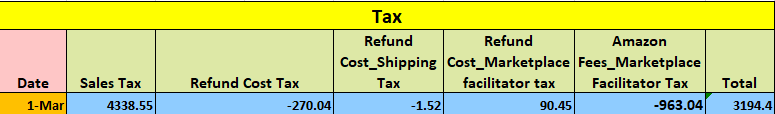

Tax

If you want to know your profit, then you will need to know how much you are paying for tax as this is an unavoidable part of your business expense.

Calculated as followed:

(Sales-Tax) + (Refund Cost-Tax) + (Refund Cost – Shipping Tax) + (Refund Cost-Marketplace Facilitator Tax) + (Amazon Fees – Marketplace Facilitator Tax)

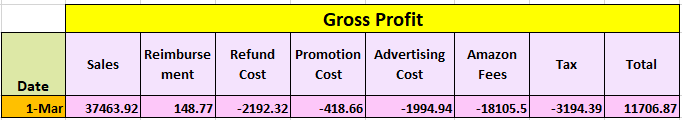

Gross Profit

You need to calculate your gross profit to know if your sales are profitable. You need to take your gross sales amount minus all expenses related to goods, Amazon fees and taxes.

Calculated as followed:

Sales + Reimbursements + Refund Cost + Promotion Cost + Advertising Cost + Amazon Fees + Tax

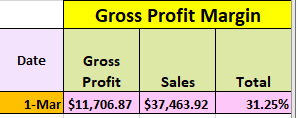

Gross Profit Margin

Gross Profit margin enables you to measure the health of your business on Amazon. You can analyze the fluctuation of the Gross Profit Margin percentage and see directly if there’s any anomalies in your sales performance.

Calculated as followed:

Gross Profit / Sales * 100%

Monitor your Amazon Fees with Us

To sum up the Amazon fees are sorted in 7 categories:

- Added Value Service (Giftwrap)

- Shipping

- FBA Fees

- Taxes

- Referral Fees

- Storage Fees

- Subscription

We recommend you use our software BigCentral to automatically generate a profit and loss statement.

BigCentral you can easily monitor your business profitability. BigCentral provides you all the details you need to know to keep a steady track on your account health. You can have a precise overview of your selling activities and all the costs you pay and the profit you make day by day.

In conclusion, subscribing FBA program when you sell on Amazon is very helpful. However, the more diverse your products are, the more complex the fees would be, and it can make things extremely confusing for sellers to keep track.

We recommend you pay attention to your business accounting to make sure that the services you are paying for on Amazon are worthwhile and not eating into your profit.

Amazon Accounting Series ✨

🔗 Amazon Accounting I: How to Tell If Your Amazon Business Is Profitable?

🔗 Amazon Accounting II: How to Calculate Refund and Return Cost?

🔗 Amazon Accounting III: How to Calculate the Reimbursement?

🔗 Amazon Accounting IV: How to Calculate the Advertising & Promotion Cost?

This post was published by Pauline Thomere on 11th March 2022 and updated by Naimi Ismadi on 15th May 2025.

Start your 14-day free trial and get instant access to your visual and comprehensive P&L report with Big Central now.